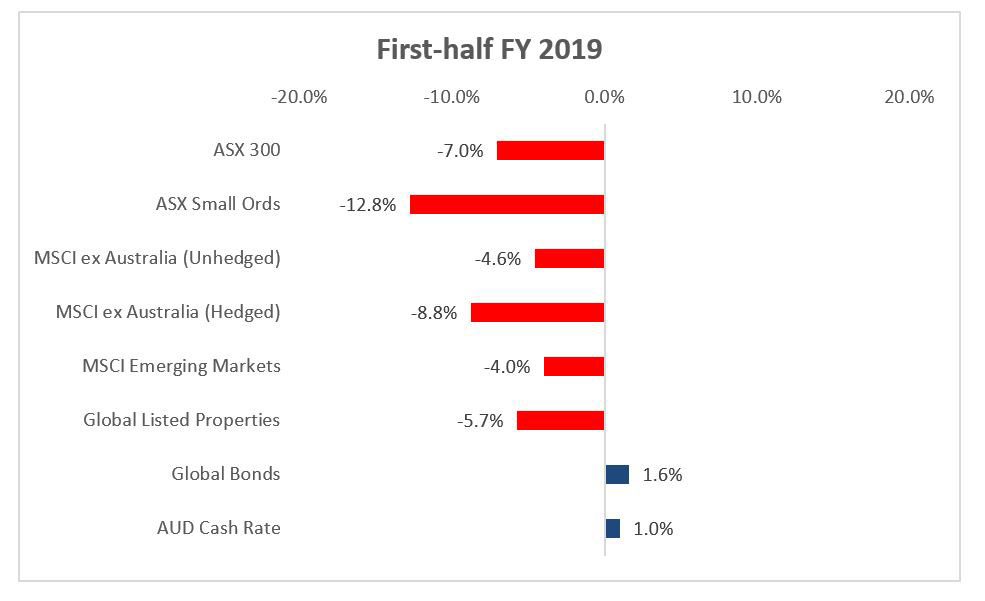

Any review of the 2019 financial year will reveal a tale of two halves. While the years returns turned out ok, it is a great reminder of how concentrated financial market returns can be. It’s also a great reminder of why we need to manage through all periods of the market cycle rather than reacting to the short-term noise.

Back in April I wrote An Investor’s Emotional Response on the Market, which documented the period from 1 October 2018 through to 21 December 2019, where the Australian share market dropped by 12%.

These periods are particularly challenging for newer investors who might be forgiven for thinking, “I never knew I had signed up for this.”

What was happening in the first half was the market reaction to the possibility of a global economic downturn, driven by the US-China trade war.

We had also seen the US Fed raise interest rates twice when many were questioning just how robust the US economy was. While US unemployment was low there were few signs of tightening in the economy and even less evidence of inflation becoming a problem.

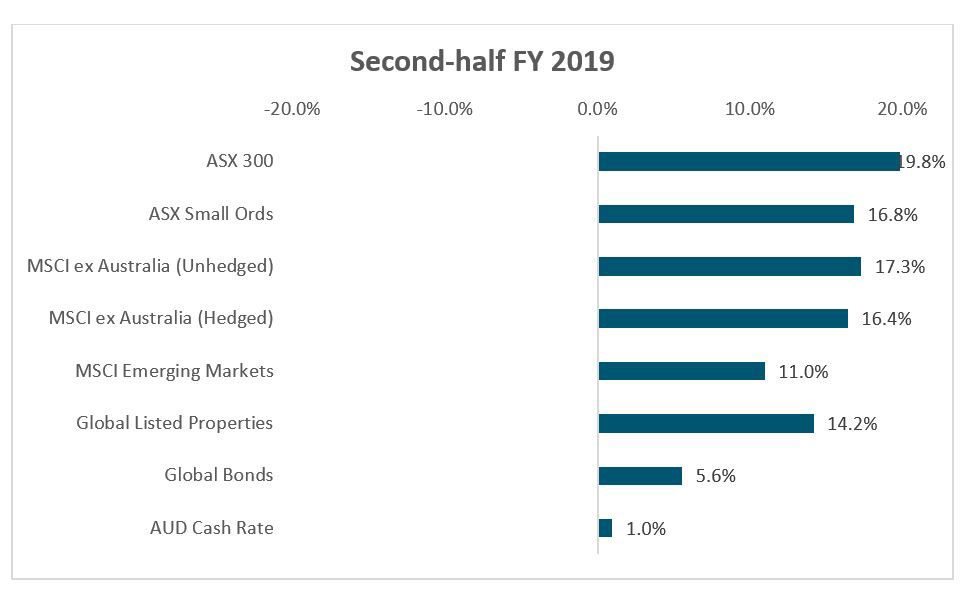

The new year heralded a change in sentiment. The Federal Reserve announced the end to rising interest rates, and China responded to their slow-down with increased spending and tax cuts.

In Australia, the banks benefited from the Hayne Royal Commission’s relatively soft conclusions, and major miners have continued to benefit from strong iron ore prices.

The result was strong performances across most asset classes in the second half of the year.

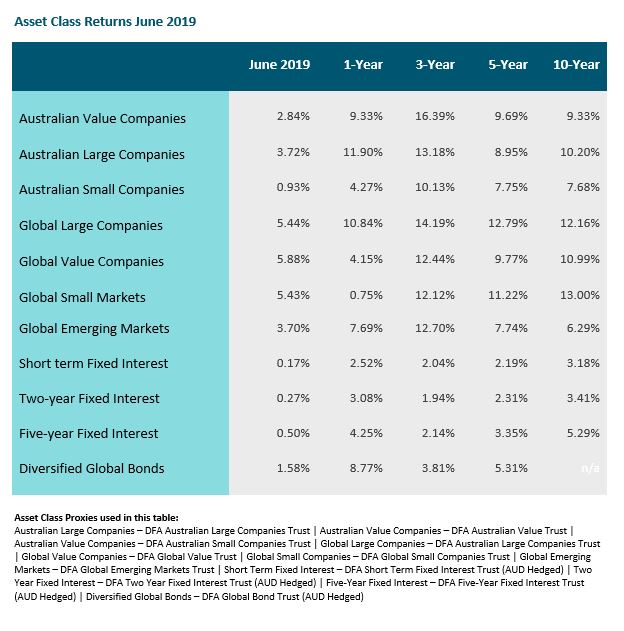

For the major asset classes in Australia, large growth companies have been the flavour of the day for the past twelve months. Value, (or relative price) stock have under-performed on a relative basis over one year, but remain stronger over the longer term.

Smaller companies have struggled relative to larger stocks, and perhaps this is a reflection of the true state of the economy.

Overseas the large growth companies have been the clear winners, driven by the technology sector. (Apple +25%, Amazon +26%, Facebook +46%, Microsoft +32%). This has left value and small company stocks languishing by comparison.

When we see a period where growth stocks dominate returns, it is perhaps easy to jettison our commitment to value and smaller companies. It may be easier to share in the excitement of returns from growth stocks and be tempted to climb on board.

A gentle reminder of the research factors is important here.

Value and small companies have a higher expected return for a reason. Their cost of capital is higher and so therefore is the risk. When markets are hot, growth stocks almost always win in the beauty competition. However, in the long-term, the benefits of holding a diversified portfolio of value and smaller companies in addition to growth companies makes a lot of sense.

In a world filled with political, economic and social uncertainty, sound financial advice – advice based on evidence and your values and life goals – holds the key to a happier, healthier life. This is what we believe at Capital Partners. And our experience helping hundreds of clients build wealth with purpose bears this out.

Read more about our evidence-based approach to wealth planning, investment management, legacy planning and insurance.