In the Aesop’s fable of the tortoise and the hare, the hare is so confident of winning the race that he stops to have a nap. Meanwhile, the tortoise plods along without stopping, and to the hare’s utter surprise, wins the race. The moral lesson of the story is that we can be more successful doing things slowly and steadily than acting quickly and impulsively.

This can also be applied to our reactions to a volatile stock market.

Last week’s return of market volatility has prompted me to go a step further than I have before to explain the brain science behind why we react to short-term bad news in financial markets, and what to do about it.

We are not sure whether the Trump Trade War will end up in a recession or not; nor can we be sure how China will respond to the Hong Kong problem. Then there’s the risk of the UK crashing out of Europe in a no-deal Brexit.

All of these issues are cause for concern. They may all happen, or none may happen. How markets react to these events is highly unpredictable as we have no idea of knowing how investors will react if fear grips the markets. What we do know for sure is that a fear response is the worst possible course of action.

What does our brain science have to do with this?

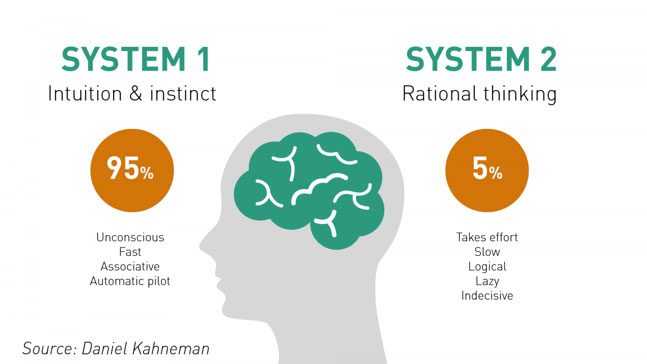

In 2002, Daniel Kahneman- a behavioural psychologist – won the Nobel Prize in Economics, despite never having taken a single economics course! He later published Thinking Fast and Slow which outlines that the human brain has two thinking systems which profoundly influence the way we make decisions and respond to different stimuli.

System 1: Thinking Fast

System 1 is fast, emotional, automatic, relies on stereotypes and habits – its our unconscious mind. As we can see from the diagram above, it is responsible for 95% of our daily decisions without any conscious effort on our part. It is what enables us to drive, converse, dress and conduct most of our lives without any conscious effort. The brain creates pathways for stimuli it has seen before and this enables us to respond quickly and efficiently – automatically – to many stimuli.

It is also the system that leaves us exhausted after fright or shock – a near miss, or receiving bad news. Often our emotional response to the shock or news is disproportionate to the actual impact of the event.

System 2: Thinking Slow

System 2 is the reason we humans can be rational. We stop, we think, and we process the information at hand. System 2 is slow, requires effort, is logical, calculating and rational. The brain only reverts to System 2 when absolutely necessary because System 2 is much harder.

This is the part of the brain where rational, strategic thinking takes place, the kind of brain activity we want to be relying on when we are making important investment decisions.

System 2 is where we need to undertake the psychological preparation for the inevitable market falls so that when they occur, we can dismiss the System 1 response.

What happens when markets fall?

The science of economics assumes humans are rational and that we all act in our own self-interest. This is the assumption Kahneman et.al. were able to disprove. While we are rational some of the time, under duress our System 1 thinking is dominant and we tend to react to a volatile stock market with panic.

The initial response when we hear of a market fall is closely connected to our fear of loss. Kahneman called this loss aversion. It is a human emotional response where we are disproportionately more unhappy with a $100 loss than we are happy with a $100 gain.

In the book What I learned losing a Million Dollars author Brendan Moynihan offers the following:

“Emotions are neither good nor bad; they simply are. They cannot be avoided. But emotionalism (i.e., decision making based on emotions) is bad, can be controlled, and should be avoided.

Emotions are very strong feelings arising subjectively rather than through conscious mental effort. As will be shown shortly, the fundamental characteristic of a crowd is that it is exclusively guided by unconscious motives. In other words, it is guided by emotions. If you don’t have conscious control of your actions, then your emotions have control of you. Therefore, in order to understand how emotionalism adversely affects you as an investor, trader, or speculator, you have to know the characteristics and behaviours of the crowd.”

Where we can’t completely ignore our emotions, we can make appropriate preparations so that when an event occurs, we can be prepared to make good decisions rather than emotional decisions.

None of this says we won’t feel the emotion. When our safety or future security is at stake, we undoubtedly feel the need to respond. This is where we need to be in conscious control of our emotions.

Psychological Preparation

No rational person would argue that the time to insure your home is when the home has already burned down. Clearly, the time to manage that risk is the day before you take possession and move in.

In investing, the time to prepare for a market downturn is well before the event happens. We do this by ensuring our expectations are realistic and mapping out a plan to respond. Any assessment of stock market returns over the past 100 years, tells us markets will rise and fall regularly. It has happened in the past and it will happen in the future.

Decide an appropriate risk budget – every investor can decide how much stock market risk they want exposure to. Normally, the decision revolves around how much return is needed to achieve certain goals; how much legacy you want to leave behind and so on. Part of this discussion should involve how much risk you can tolerate.

Discuss portfolio expectations – for any proposed portfolio, a good analyst can provide all the historical data about how the portfolio has behaved in the past. You should be aware of the highs, the lows and how the portfolio has performed historically before you invest.

Discuss how you will react during a market downturn – I often liken this to being on a plane trip. On a flight it’s not uncommon to hear the Captain say, “ladies and gentlemen this is the Captain. We are about to pass through some turbulence. Can you please return to your seat, stow your tray table and fasten your seat belt.’

What does everyone do? That’s right, exactly what the captain has asked of them. It doesn’t make the turbulence any more enjoyable and some people are genuinely fearful, but we strap in tight.

Investing during market turbulence is no different. We need to strap in and ensure all the pre-planning we have done in building an appropriate portfolio is put to good work. Letting our rational brain dominate our impulsive brain is the best remedy to winning the investment race.

That’s how the tortoise beats the hare.