It seems that choosing a financial planner is one of the more difficult things to do in life these days if the findings of the Royal Commission are to be believed. And yet for many Australians, they simply wouldn’t or perhaps couldn’t, approach retirement planning and other important life decisions without the help of a qualified financial planner.

There’s been a lot written during the Royal Commission hearings about the poor behaviour of some financial advisers and major institutions, and in this article, I want to shed light on some of the issues consumers need to think about when choosing an adviser.

Much of the focus of attention in the Royal Commission has been on the misselling of financial products. This happens when the interests of the financial adviser conflict with the interests of the client. In other words, it is in the adviser’s financial interest to make a sale rather than fulfil a clients’ needs.

In his interim report, the Commissioner refers to an ASIC report1 released in January 2018 that found that in 75% of the files reviewed the adviser appeared to have prioritised the adviser’s own interests (above their clients’ interests). And in 10% of the files, ASIC expressed ‘significant concern’ about the impact of the advice on the client’s financial situation. These investigations focused on ANZ, CBA, AMP, NAB and Westpac whose vertically integrated models have come under stinging criticism.

So what is a vertically integrated model?

So what is a vertically integrated model?

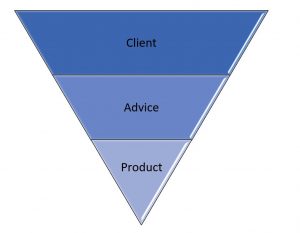

It is simply where one institution owns every stage of the product, sales and ‘advice’ delivery chain. The value chain works on the premise that the institution is primarily a manufacturer of the product. This is where most of the profit lies. As we see in the diagram the product is in prime position.

What happens next is a conversation about how to best distribute or sell the product, and finally, there is a customer needed in order to fulfil sales targets.

In this model, it is very difficult for an adviser to place their own interests behind the clients. As the Royal Commission report states, “the choice between interest and duty is resolved, more often than not, in favour of self-interest.

Readers may be aware of the term Caveat Emptor which translated means let the buyer beware.

How is a fiduciary adviser different?

How is a fiduciary adviser different?

The term fiduciary describes a very different relationship between the client and the adviser. A fiduciary has a legal or ethical relationship of trust with another and prudently takes care of money or assets for another person.

In this model of financial advice, the triangle is inverted and instead of the product being the most important focus, it is the client whose interests are the primary focus. The inversion of the triangle forces a change of thinking so that the question is no longer ‘how can I sell my product?’ but ‘how can I best help my client?’

Selling a product is not an issue for a fiduciary adviser, because they don’t have a product of their own to sell. Instead, the fiduciary is free to scan the market for the best possible investments to serve the interests of the client.

For Australian consumers, this is a very difficult area to navigate. ASIC sets the bar for the use of the word Independent or independent adviser so high that very few financial advisers can use the term, even those who are certified, fiduciaries.

Capital Partners is proud to be an independent firm.

As investment advisers, we are certified fiduciaries and we are audited each year to ensure we meet the fiduciary standards. We don’t receive a single penny of investment commissions so the only way we are paid for our financial planning and investment services is through agreed fee arrangements with clients.

Capital Partners is the FPA Professional Practice of the Year and the IFA Boutique Advice Firm of the Year. We are committed to upholding the highest fiduciary standards, ensuring that the people who team up with us will live richer, happier lives.

1 ASIC, Report 562: Financial Advice: Vertically Integrated Institutions and Conflicts of Interest.